How to Determine Which Forex Liquidity Provider Is Right for Your Brokerage

Successful FX brokers can’t function without access to reliable Forex Liquidity Provider. Having a solid relationship with a trusted liquidity provider can help you provide your customers a smooth trading experience. Thus, selecting an FX liquidity solution is a weighty one for your business’ success. In this blog post, we’ll show you how to determine which liquidity provider is right for your brokerage. We’ll also give you tips on selecting a provider that meets your needs. So, whether you’re just starting out or you’re looking for a new provider, read on for information that will help you make the best decision possible.

Who are Liquidity Providers?

Liquidity providers are the financial institutions that supply the capital for Forex transactions. In other words, they’re the ones who provide the money that’s traded in the market. Retail brokers, like FXCM, don’t trade with their own money. Instead, they act as an intermediary between traders and liquidity providers. When a trade is executed, it’s actually done between the trader and the liquidity provider. The broker simply facilitates the transaction.

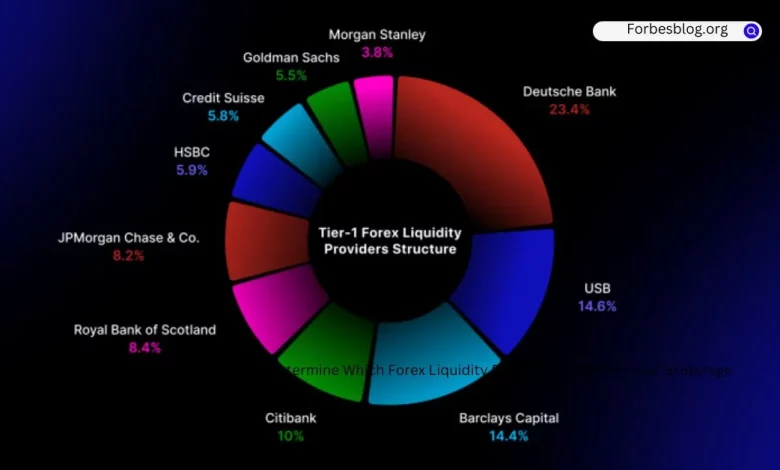

There are two types of Forex Liquidity Provider: banks and non-banks. Banks are typically large institutions, like JP Morgan or HSBC. Non-banks include hedge funds, trading firms, and other private investors.

Most banks act as both Forex Liquidity Provider and market makers. That means they’re always ready to buy or sell currency pairs, regardless of the current market conditions. They quote two prices for each currency pair: a bid price and an ask price. The bid price is the price at which they’re willing to buy the currency, and the ask price is the price at which they’re willing to sell it. The difference between these two prices is called the spread.

Market makers make money from the spreads they quote, while liquidity providers profit from the transactions themselves. When a trader executes a trade with a market maker, the market maker keeps the spread as profit. When a trader executes a trade with a liquidity provider, the liquidity provider charges a commission.

Some Forex Liquidity Provideract as ECNs or electronic communications networks. ECNs are platforms that match trades between different liquidity providers. When a trade is executed on an ECN, the broker doesn’t make any money from the transaction. Instead, they charge a small commission. This setup gives traders direct access to the interbank market and tight spreads.

Not all brokers allow their clients to trade directly with liquidity providers. Some only offer dealing desk execution, which means trades are always executed through the broker’s own dealing desk. This type of execution often leads to higher spreads since the broker will markup the price they quote from the liquidity provider. Other times, brokers may use a hybrid model, offering both dealing desk and direct market access (DMA) execution. This gives traders the best of both worlds: tight spreads and direct access to liquidity providers.

The Benefits That Liquidity Providers Bring

Liquidity providers play an essential role in the forex market. They provide FX liquidity for brokers that’s needed to make transactions, and they help to ensure that prices are stable. This liquidity is essential to the functioning of the market, and it’s one of the things that make forex trading so attractive to investors.

There are a number of benefits that liquidity providers bring to the market. First, they help to ensure that prices are stable. This is because they’re constantly buying and selling currency, which helps to even out supply and demand. Second, they provide the capital that’s needed to make transactions. This capital can be used to buy or sell currencies, and it helps to keep the market moving. Finally, liquidity providers help to ensure that the forex market is fair and transparent. By providing capital and stabilizing prices, they help to create an environment where everyone has a fair chance of making a profit.

The success of a brokerage hinges on its ability to choose reliable liquidity sources. But how do you know which ones are the best? Let’s look at what you need to consider before choosing one.

Liquidity Provider Selection Factors

When you’re choosing a liquidity provider, there are a few factors you need to consider.

- Reputation

The first thing you need to look at is the provider’s reputation. There are a lot of providers out there, and not all of them are created equal. You need to make sure you’re working with a provider that has a good reputation and is known for providing quality service. There are a few ways to do this. First, you can check online Forex Liquidity Provider and see what other people are saying about the provider. Second, you can contact the provider directly and ask them questions about their service. Finally, you can look at independent reviews of the provider. All of these will give you a good idea of what the provider is like and whether or not they’re worth working with.

- Financial Stability

Next, think about the company’s financial stability. This is important because you need to make sure your money is safe. You don’t want to work with a provider that’s on the verge of bankruptcy. There are a few ways to assess the financial stability of a provider. First, you can look at their financial statements. This will give you an idea of their overall health. Second, you can check with rating agencies. These agencies rate companies’ financial stability and they can give you a good idea of how safe your money would be if you worked with the provider. Finally, you can check with the regulator in the country where the provider is based. This will give you an idea of what kind of oversight the provider is subject to and how well they’re being monitored.

- Adherence to Regulations

The provider’s compliance with laws and regulations is the next factor to think about. This is important because you need to ensure your money is safe and the provider follows all the rules. First, you can check with the regulator in the country where the provider is based. This will give you an idea of what kind of oversight the provider is subject to and how well they’re being monitored. Second, you can look at the provider’s website and see if they have any information about their compliance with regulations. Finally, you can contact the provider directly and ask them questions about their compliance policies.

- Technology

The next thing you need to consider is the provider’s technology. This is important because you must ensure the provider has the latest and greatest technology. This will ensure that your money is safe and that you’re getting the best possible service. Look at their website and see if they have any information about their solutions. Also, you can contact the provider directly and ask them questions about their offerings. Finally, you can look at independent reviews of the provider. All of these will give you a good idea of what the provider is like and whether or not they’re worth working with.

- Pricing

Finally, think about pricing. This is important because you need to make sure you’re getting a good deal. There are a few things you can do to assess pricing. Contact the provider directly and ask them questions about their pricing or use a price comparison website. This will give you an idea of what other providers are charging for the same service.

All of these will give you a good idea of what the provider is like and whether or not they’re worth working with.

Bottom Line

For Forex brokers, high levels of market liquidity are crucial. You should make sure your broker has a reliable liquidity source to avoid any major complications. You need to think about a few things when choosing a provider for FX liquidity services, including their financial stability, compliance with regulations, technology, customer service, and pricing. All of these factors will help you decide if the provider is right for your brokerage. With proper research, you can find a provider that will give you the liquidity you need to run your business smoothly.