GST or Goods and Services Tax is the new indirect tax that has replaced older taxes like VAT and service tax. GST registration is mandatory for goods-sector businesses with an annual turnover of Rs. 40 lakhs or above, and service-sector businesses and intra-state goods and service providers with an annual turnover of Rs. 20 lakhs or above.

If you are a GST-registered goods or service provider, there are many important documents and returns that you need to file with the tax department. One such important return is the GSTR 9.

What is the GSTR-9?

The GSTR-9 is an annual return that every registered GST taxpayer needs to file before December 31 of the following financial year. So, for FY 2021-22, the GSTR-9 needs to be filed on or before December 31, 2022. While this is the general due date to file your returns for GST online, the government may also extend the due date.

The GSTR-9 form contains the consolidated information about the income and expense details of the business for the relevant financial year. Not filing your annual returns for GST online on time can lead to a penalty of Rs. 100 under the Central GST regime and another Rs. 100 under the Stage GST regime.

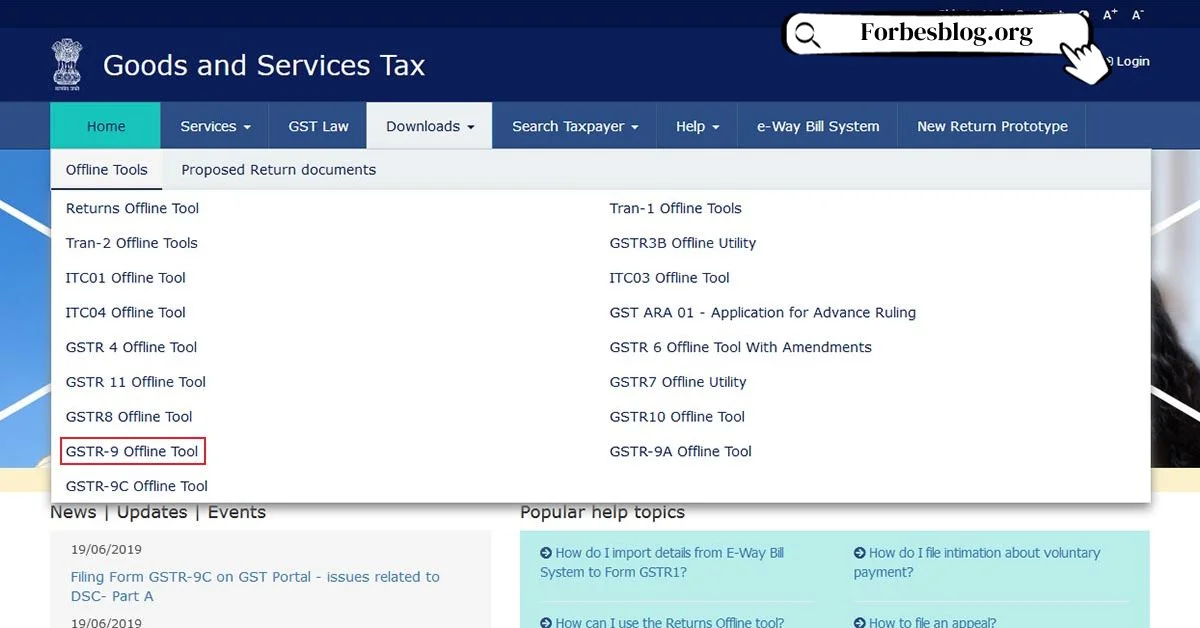

How to File Your Annual GST Return Online?

Filing your returns for GST online via form GSTR-9 is quite easy. Here is a step-by-step guide to help you out.

- Log into the GST portal and click on the ‘Services’ option in the header.

- In the ‘Returns’ section, click on the ‘Annual Return’ option.

- Select the financial year for which you wish to file your GSTR-9.

- You will then see a message showing you the steps involved in preparing your GST return online and offline.

- Then, choose whether or not you want to file a Nil return. You can only file a Nil return if the following conditions are satisfied –

- You have no outward supply

- There is no receipt of goods/services

- You have no other liability

- You have not claimed any credit

- You have not claimed any refund

- There is no demand order received

- You do not need to pay any late fees

- If you meet the above conditions, click the ‘Yes’ option and file your Nil GSTR-9 online.

- If you do not meet the conditions above, you have to click the ‘No’ option.

- The portal will display the GSTR-9 Annual Return for Normal Taxpayers, along with the options to download the GSTR-9 system computed summary, the GSTR-1 summary and the GSTR-3B summary. These downloads can help you fill in your GSTR-9 form.

- You will then see different tables for the financial year that need to be filled in. You can use the data from GSTR-1 and GSTR-3B to auto-fill some of these details. Here are some of the tables you need to fill.

- Table 4N: Details of taxable advances, inward and outward supplies made during the financial year

- Table (5M): Details of non-taxable outward supplies made during the financial year

- Table 6(O): Input Tax Credit availed during the financial year

- Table 7(I): Details of Input Tax Credit reversed and ineligible Input Tax Credit for the financial year

- Table 8(A): Other information related to Input Tax Credit

- Table 9: Details of tax paid during the financial year

- Table 10, 11, 12 & 13: Details of the transactions in the previous financial year, which are being reported in the next financial year

- Table 15: Information about demands and refunds

- Once you have filled in all the details, you can view the draft of your GSTR-9 online in the PDF or excel format. Review the draft and make any changes if needed.

- Then, click on the ‘Compute Liabilities’ option to calculate your GST dues, including late payment fees if any.

- Make the payment for your GST online.

- After this, click on the ‘File GSTR-9’ option.

- You can then choose to complete the filing with either your digital signature certificate (DSC) or via an Electronic Verification Code (EVC).

Conclusion

This sums up how you can file your GSTR-9 form online. Make sure that you enter the details correctly and completely, and pay your dues on time to avoid any late fees. Your GSTR-9 should also be filed before the due date, so you can avoid the penalty for late filing of GST online.

Visit for more articles: forbesblog.org